One of the new templates that Sheetgo has come up with is for Income and Expense.

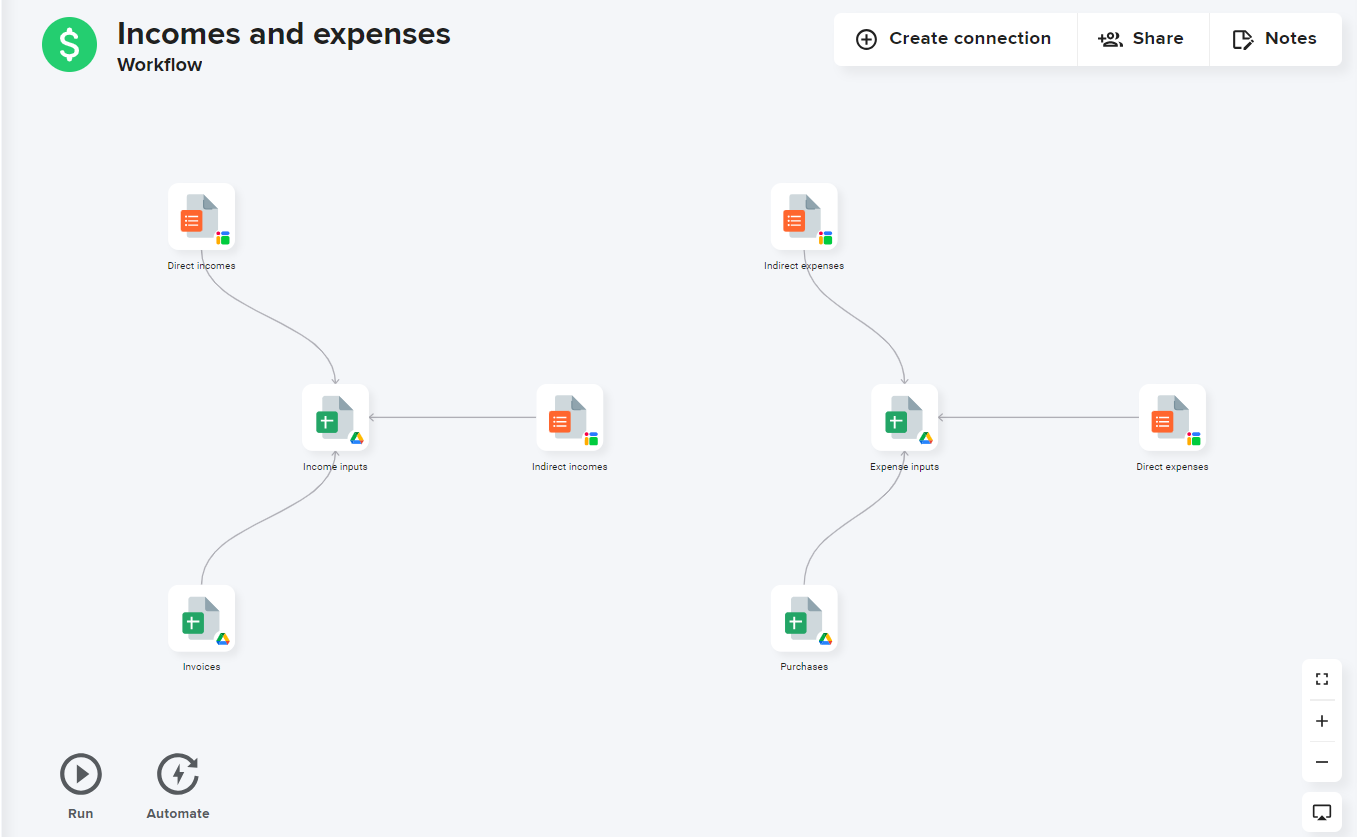

Once you install the template the workflow should look something like this

You can find this in the template gallery - or use this link to directly go to the template.

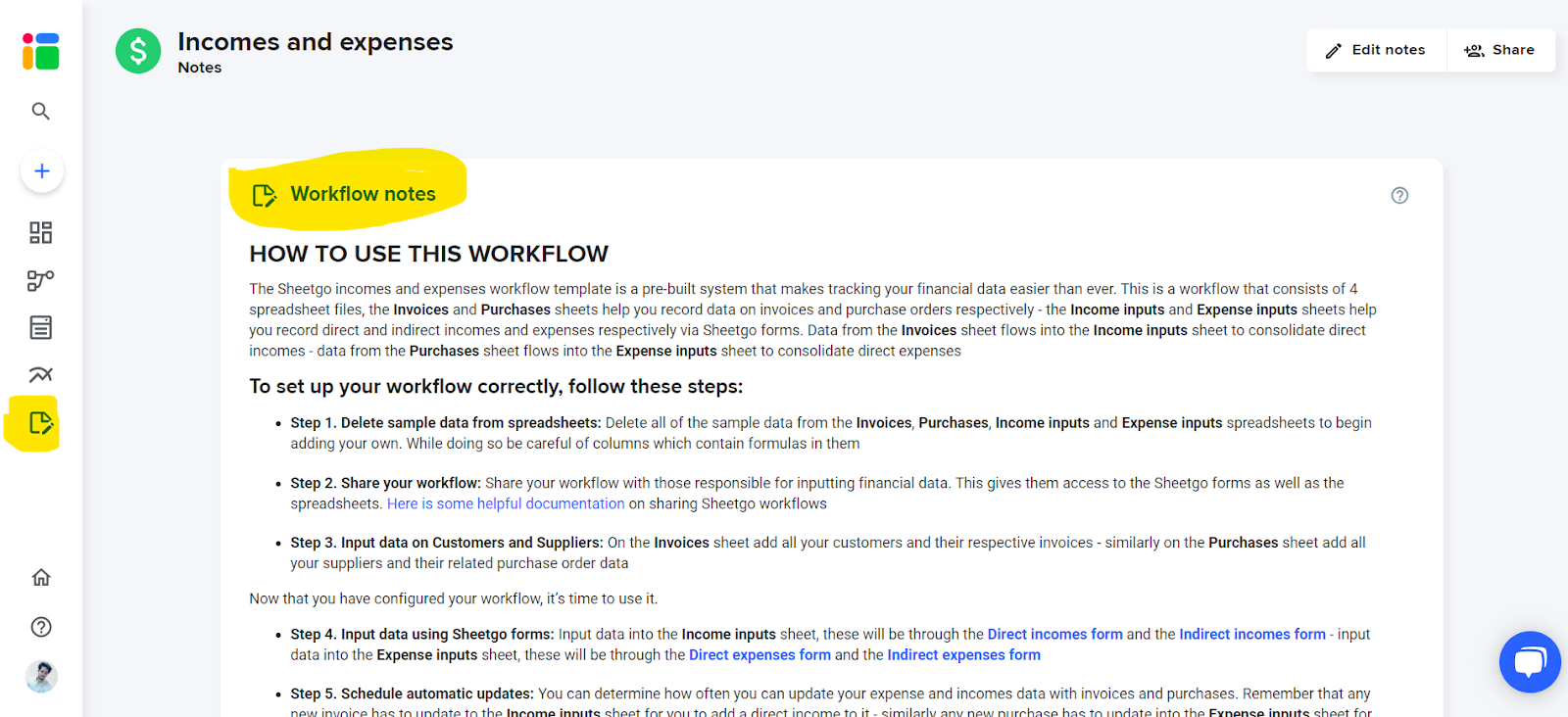

A detailed description of how to operate the template can be found in the Notes section of the workflow - you can add to these notes as well and customize it to keep track of your process

To start working with the template first clear out all the sample data from the sheet

Some columns have formulas in them usually in the header - these columns will be greyed out - while clearing out the data be careful not to remove the formulas

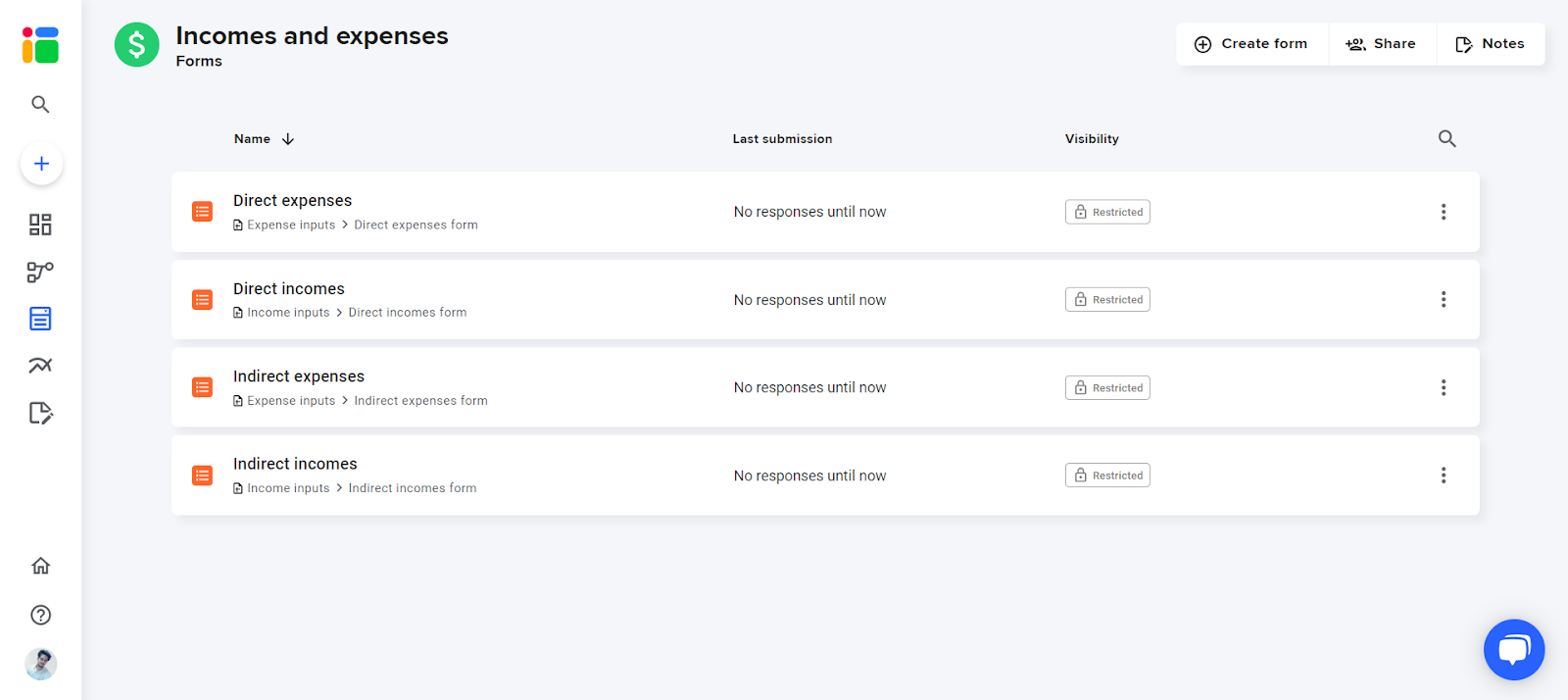

In the forms section of the workflow, forms play a crucial role in streamlining and standardizing data entry into sheets, with four forms facilitating the system - two for income levels and two for expense levels.

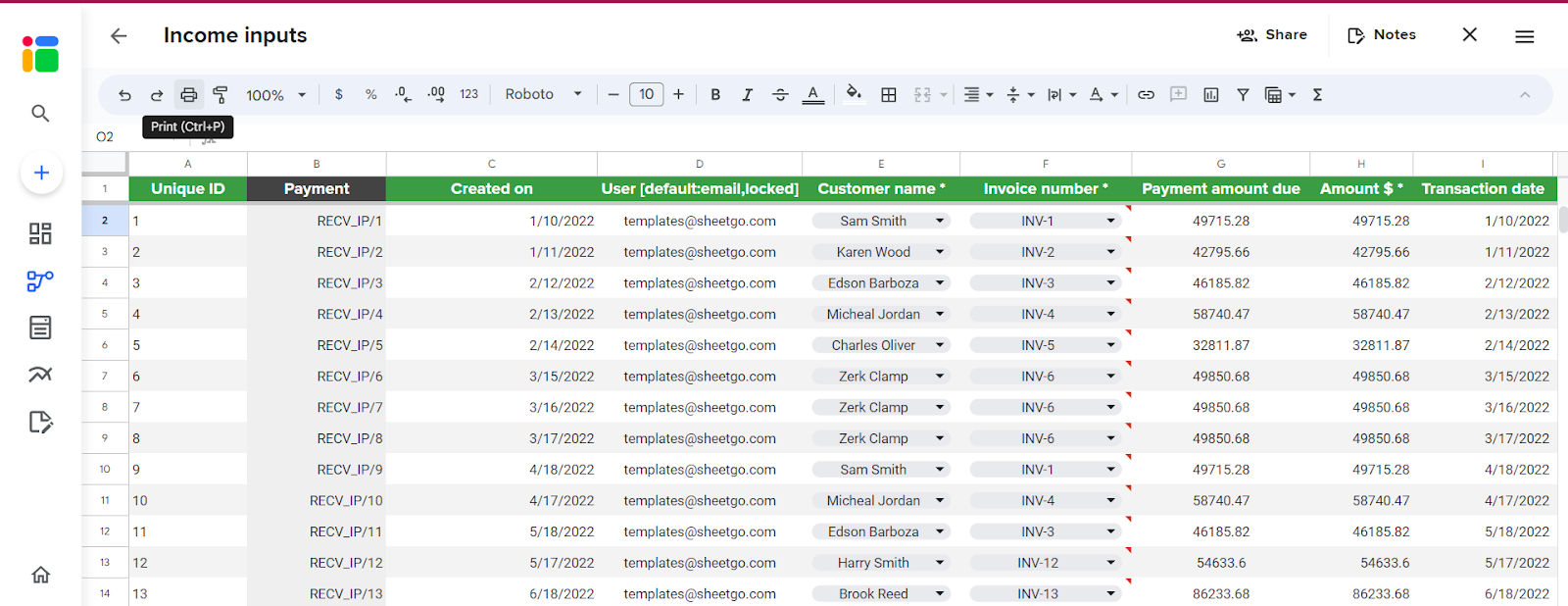

Direct income is the revenue earned from an entity’s main activities, such as salaries for individuals and sales for businesses.

The Direct Income form simplifies revenue recording by capturing customer name, invoice number, and automatically reflecting the invoice amount. It also allows for manual input of additional amounts, along with specifying category and account details, streamlining record-keeping and providing valuable insights into income sources.

Indirect income comes from non-primary sources like investments or rentals, supporting but not stemming from the core operations.

For the indirect income form, the same input fields as in the direct income form are used, but “customer name” and “invoice number” are replaced with “reference name” and “reference number,” respectively.

Moving to the expense section, the process mirrors that of the income section.

Direct expenses are costs directly related to the production of goods or services, such as raw materials and labor for manufacturing. These vary with production levels.

Direct Expense Form: Utilize the same input fields as in the direct income form, but replace “customer name” and “invoice number” with “Supplier name” and “PO number.”

—

Indirect expenses are overhead costs not directly linked to production, like rent, utilities, and administration. They’re necessary for overall operations but don’t fluctuate with production volume.

Indirect Expense Form: For the indirect expense form, utilize the same input fields as in the direct expense form, but replace “supplier name” and “PO number” with “reference name” and “reference number,” respectively."

Moving to the dashboard section:

The Sheetgo income and expense workflow dashboard offers a dynamic and detailed visual representation of a business’s financial status. It tracks monthly expenses, showing a peak in mid-year with a significant drop later on, and categorizes these expenses to highlight areas like COGS and SG&A. The income overview similarly depicts the revenue trends with notable fluctuations and a sharp decrease in October. With sales comprising the majority of the income, the dashboard underscores the reliance on sales revenue and suggests the potential to diversify income streams. In a community post, the focus would be on Sheetgo’s utility in providing actionable insights and the benefits of automating and integrating financial data management.